Selling on online marketplaces is one of the most effective ways for brands and retailers to extend their reach by attracting legions of new customers around the world. As ecommerce is growing its share of retail sales across all markets, the organic growth potential looks very appealing.

Let’s look at the figures: in 2025, global retail ecommerce sales are expected to reach about $7.4 trillion, up sharply from roughly $6.1 trillion in 2023, and accounting for over 20% of total retail sales worldwide. The U.S. ecommerce market remains one of the largest, with online retail revenue projected near $1.3 trillion in 2025, supported by strong mobile shopping growth and major marketplace expansion.

China continues to lead as the world’s largest ecommerce market, representing around 39% of global online retail sales, with total online sales in the country well over $1.4 trillion in recent years. Taken together, China and the USA drive a dominant share of global ecommerce, though the majority of ecommerce opportunity still lies outside these two countries across fast-growing regions in Asia, Europe, Latin America, and Africa.

There are distinct strategic benefits to selling on marketplaces: brand exposure, increased GMV, and better margins. But which marketplaces are the best bet for your roadmap to world domination, and how can you select the right channels for meeting your strategic objectives? Let’s dive in and explore the potential for your brand.

The best marketplaces for global selling

It would be easy to think you can cover most of the market just by selling via the big multinational marketplaces. To be fair, this would capture a big slice of the total, but this approach is also an oversimplification that ignores much greater sales opportunities.

Instead, we at ChannelEngine see that brands and retailers consistently achieve superior selling results when they combine familiar ‘global’ names (Amazon, eBay, etc.) with local players and niche marketplaces for specific product categories or customer types. This tactic ensures that your brand can still reach customers who prefer their local sales channels, and it can potentially generate better margins too.

Sure, Amazon is still the world’s most popular marketplace, grabbing a hefty 37.8% of online sales; however, up-and-coming marketplaces like Tmall and JD.com are closing the gap and have a bigger presence in China. New sales models such as TikTok Shop and other social commerce channels are also swiftly gaining popularity – these are estimated to be growing at a rate of 31% each year. Opportunities like these cannot be ignored for the sake of mere simplicity.

Selecting the best marketplaces for your brand will depend a lot on your specific brand strategy. If you’re aiming for brand exposure, then visitor traffic will be a good indication of candidate marketplaces and other sales channels.

However, if you’re looking to increase total sales/GMV, then marketplace revenue is a better guide. And, when you want to get the best margins, it makes sense to target countries with mature internet/ecommerce infrastructure and relatively high purchasing parity as a major consideration in your marketplace strategy.

Once you’ve seen how unsustainable manual marketplace management can be, the value of automation becomes crystal clear. It’s not just about saving time—it’s about removing the friction that slows down your growth and increases operational costs.

Now that you’ve seen how automation can streamline your marketplace operations and unlock growth, let’s take a closer look at the leading marketplaces around the world. We’ll explore their scale, visitor volumes, and regional strengths, helping you identify the right channels for maximizing your brand’s potential.

The top 5 marketplaces in the world (by GMV)

#1 Amazon

Amazon is the world’s #1 marketplace in terms of GMV across all its domains. Amazon.com took a total of $362 billion in 2022, and the other Amazon domains (combined) generated US$692.7 billion. The other top 5 domains are: Amazon.co.jp, Amazon.co.uk, Amazon.de, and Amazon.ca. The strongest growth for Amazon was seen in Egypt, which experienced 423% growth in 2021-2022, compared to an average growth rate of 6% for Amazon. Growth like this shows the potential for brands that can break into emerging ecommerce markets at an early stage. This marketplace covers almost every category imaginable, so there’s a space for most brands here.

#2 Taobao

This marketplace features some businesses, but it’s still primarily focused on consumers selling to other consumers (C2C). Taobao is part of the Alibaba group, and generated revenue worth US$616.8 billion in 2022, with annual growth of 0.3%. Although Taobao has already formed a dedicated B2C channel, Taobao Mall – which became Tmall (below), this might be one to keep an eye on for the future. Other ‘C2C’ marketplaces (such as eBay) have evolved to become thriving B2C and B2B selling hubs, and there are many business sellers on the Taobao platform.

#3 Tmall

Also part of the Alibaba group (like Taobao, above), Tmall is one of the most popular online marketplaces in the world. Tmall came into existence as a dedicated B2C ‘mall’ under the Taobao umbrella, but has now become something much more. Customers spent more than US$596.9 billion on Tmall in 2022, up 0.3% on the previous year. A great way to reach customers across Greater China.

#4 JD.com

JD.com is the biggest online retailer in China, based on net revenue for the company, but it takes the #4 spot, based on GMV. The company has extensive fulfillment infrastructure and a prominent vendor-model (1P) sales stream that generates healthy revenues for the company while allowing brands to gain new customers in an effortless way. In 2010, JD.com launched the JD.com marketplace for 3P selling, and the JD.com Worldwide platform now facilitates cross-border selling with a very low threshold. JD.com generated GMV of US$570.1 billion in 2022 (including JD.com’s own net revenue of US$151.7 billion), and this is growing at 11.5% annually.

#5 Pinduoduo

Pinduoduo stands out as a distinguished player among marketplaces. It’s a mobile-only platform, and it has strong connections to agriculture. As a result, millions of Chinese shoppers use the platform to buy groceries (and other products), often from local suppliers and brands. The platform now covers almost every kind of product category, and is owned by the same parent company as up-and-coming marketplace Temu. With annual growth of 43% and GMV of US$541.2 billion in 2022, it’s maybe one to consider.

The world’s 20 most popular marketplaces

(by visitor traffic)

Of course, marketplace GMV isn’t always the best indicator of your brand’s potential revenue, and it may ignore markets where your products would be warmly received. Costs and competition need to be considered too, as well as other factors that impact margins. When we look at the biggest 5 marketplaces based on GMV above, we see that these include C2C marketplaces and product category foci that may not suit many online businesses or brands.

Instead, it can be useful to see which marketplaces have the greatest numbers of visitors, and which countries these can reach.

#1 Amazon

Originally started in 1994 as an online book merchant, Amazon has grown into a full-fledged online marketplace. Amazon gives consumers around the world access to products across every category, sold directly by Amazon and by third-party merchants (marketplace sellers). As the company has grown, so has the range of services on offer, including Amazon Web Services, Alexa, Twitch, Whole Foods Market, and more.

- Monthly visitors: 4790 million

- Regions covered: Global

- Product Categories: Broad focus, many categories.

#2 eBay

Ebay rose to fame as a consumer-to-consumer auction website but has since become a well-developed marketplace with a full range of business sellers, brands, and retailers. The very first item ever sold on eBay (then called ‘Auction Web’) was a broken laser pointer, listed by eBay’s founder in 1995. Back then, customers would send payments as coins taped to index cards. Today, more than 187 million people use eBay to buy goods from 1.5 billion listings – of which around 88% are fixed-price listings. Product categories range from raw materials to real estate worth millions of dollars.

- Monthly visitors: 1210 million

- Regions covered: Global

- Product Categories: Broad focus, many categories.

#3 Rakuten

This Japan-based marketplace has a solid presence around the world. It acquired US Buy.com in 2010, and France’s PriceMinister in 2010. Over the years, the company has grown into a wide-ranging integrated online business, including its thriving marketplace, TV streaming services, and the Viber messaging app.

- Monthly visitors: 563.37 million

- Regions covered: Global

- Product Categories: Broad focus, many categories.

#4 Shopee

Based in Singapore, Shopee was launched in 2015 as a mobile-first platform. Originally a C2C platform, Shopee has expanded into a B2C marketplace that serves multiple markets in the SEA region. It has also started to expand into other markets in Latin America, competing with tough local competition like Mercado Libre (see below).

- Monthly visitors: 559.59 million

- Regions covered: Southeast Asia

- Product Categories: Broad focus, many categories.

#5 AliExpress

AliExpress started in 2010 as a more agile form of the B2B procurement platform Alibaba, facilitating easy access to low-volume ‘sample purchases’ from B2B businesses based primarily in China. Since then, it has developed into an eBay-like B2C marketplace, enabling businesses to sell directly to consumers around the world.

- Monthly visitors: 525.45 million

- Regions covered: Global

- Product Categories: Broad focus, many categories.

#6 Etsy

This is a niche platform for handmade or vintage items and craft supplies. Sellers are primarily small businesses that hand-make products across numerous categories. Founded in 2005 in the USA, the platform now operates in 27 markets including North America, Europe, and Australia. It may not be commercially interesting for most brands, but the popularity of Etsy is a clear indication that consumers want a closer connection with the businesses they buy from.

- Monthly visitors: 447.31 million

- Regions covered: Global

- Product Categories: Arts, Crafts, & Gifts

#7 Walmart

Founded by Sam Walton (and his brother Bud) in 1962, Walmart started out as a high-volume, low-margin enterprise that gained market share through fierce competition. As a brick-and-mortar retailer, Walmart made the move to ecommerce by opening its own webstore in 2000, originally offering just its own products. The Walmart marketplace became active in 2009 and really started to gain momentum from 2016 onwards.

- Monthly visitors: 407.61 million

- Regions covered: North America

- Product Categories: Broad focus, many categories.

#8 Mercado Libre

Mercado Libre (or ‘free market’ in Spanish) is the most popular marketplace in Latin America, attracting more than 148 million users. This Argentine company is headquartered in Uruguay and incorporated in the USA. It has grown impressively, and now offers integrated payments and financial services, as well as a marketplace covering every kind of product category.

- Monthly visitors: 362.90 million

- Regions covered: Latin America

- Product Categories: Broad focus, many categories.

#9 Wildberries

This Russian marketplace was started by Tatyana Vladimirovna Bakalchuk in 2004, while she was on maternity leave. It has since grown into Russia’s largest marketplace. Both the marketplace and its founder have since been subjected to sanctions for supporting Russia’s war against its neighboring country, Ukraine. Due to the ongoing geopolitical situation and instability of the Ruble (the official Russian currency), this market has unfortunately become unattractive from both a business and moral perspective - for the time being.

- Monthly visitors: 342.85 million

- Regions covered: Russia, Armenia, Belarus, Kazakhstan, Kyrgyzstan, and Uzbekistan

- Product Categories: Broad focus, many categories.

#10 Ozon

Ozon has followed a similar path to Amazon. Founded in 1998 as an online bookstore, Ozon grew via a series of acquisitions into a massive marketplace that has become known as ‘The Amazon of Russia’. Due to the Russian invasion of Ukraine, most global brands have halted the sales of their goods in Russia, and the company was forced to ‘voluntarily’ delist from the Nasdaq. Today, this gap is being filled by Chinese retailers and brands; Ozon aims to have 100 000 Chinese sellers on the site by 2024.

- Monthly visitors: 316 million

- Regions covered: Russia

- Product Categories: Broad focus, many categories.

#11 Taobao

Taobao is one of the most-visited websites in the world, and the Taobao app has 895 million monthly users. Primarily focusing on C2C transactions, the platform also features business sellers (B2C). Taobao is part of the Alibaba Group.

- Monthly visitors: 303.43 million

- Regions covered: China

- Product Categories: Broad focus, many categories.

#12 Pinduoduo

This mobile-first platform based in China is predicted to grow faster than its major competitors, with an estimated growth rate of 17.6% in 2024, beating rivals JD.com and Alibaba. No stranger to controversy, the Pinduoduo app was removed from the Google Play store, as it was found to be full of malware and spyware. The company responded to this by swiftly removing the engineers who developed the app, and transferring them to its sister company, Temu.

- Monthly visitors: 227.66 million

- Regions covered: China

- Product Categories: Broad focus, many categories.

#13 Lazada

Lazada is one of the largest online marketplaces in the SEA region, serving about 160 million customers. Based in Singapore, over 1 million sellers list items for consumers in six key markets. By 2030, Lazada aims to grow its customer base to 300 million. It became part of the Alibaba group in 2016.

- Monthly visitors: 211.72 million

- Regions covered: Southeast Asia

- Product Categories: Broad focus, many categories.

#14 Allegro

Allegro is the largest home-grown European ecommerce player and Poland’s #1 shopping platform. Approximately 20 million users buy products every month on the platform, selecting from over 320 offers.

- Monthly visitors: 198.62 million

- Regions covered: Poland and 5 other European markets

- Product categories: Broad focus, many categories.

#15 Flipkart

Flipkart began as an online bookseller in 2007. Thanks to organic growth and a series of acquisitions, the company has become a dominant player in the rapidly growing Indian market. Walmart is a majority stake owner in the company, outbidding Amazon in 2018.

- Monthly visitors: 161.10 million

- Regions covered: India

- Product categories: Broad focus, many categories.

#16 Target

A longtime fixture of the American strip mall, Target has become a successful online retailer with an invite-only marketplace for brands. Practically every category of product is available. Good to know: the company mascot is a bull terrier called ‘Bullseye’.

- Monthly visitors: 158.40 million

- Regions covered: USA, Australia

- Product categories: Broad focus, many categories.

#17 Zalando

Zalando is the #1 destination for Fashion products, serving more than 50 million customers across Europe. Since 2010, the company has steadily expanded into the rest of Europe, including the fast-growing eastern-European markets. It is now active in 25 markets, including the top 5 markets in Europe.

- Monthly visitors: 149.32 million

- Regions covered: Europe

- Product categories: Fashion

#18 JD.com

JD.com is the largest B2C marketplace in China, and it is fiercely competing with Tmall to be in the top position. Also known as Jingdong (and Joybuy internationally), JD.com has a sprawling business that includes advanced technologies. During the COVID pandemic, JD.com pioneered the use of delivery drones and robots to ensure customers could access vital supplies.

- Monthly visitors: 143.36 million

- Regions covered: China

- Product categories: Broad focus, many categories.

#19 Trendyol

Trendyol is Turkey’s biggest ecommerce platform, delivering more than 1 million packages a day to consumers. A wide selection of goods is available, including a strong fashion segment. The Alibaba group has a controlling share in the company, which has grown rapidly since its founding in 2010. It offers an integrated ecommerce experience to customers, who can use its ‘superapp’ to access the marketplace, delivery services, grocery and food delivery, payment services, and more. Currently active in Turkey and Germany, Trendyol delivers to 27 European countries and plans to expand more in the coming years.

- Monthly visitors: 138.10 million

- Regions covered: Turkey

- Product categories: Broad focus, many categories.

#20 Mercari

Mercari is a wildly popular Japanese online marketplace, founded in 2013 and now also active in the USA. Like many of the platforms launched in the smartphone era, Mercari quickly adopted a mobile-first business model. The emphasis is strongly on C2C transactions, with the idea that users can easily ‘declutter’ by easily listing and selling via the Mercari app, and using easy integrated shipping options.

- Monthly visitors: 125.55 million

- Regions covered: Japan, USA, UK.

- Product Categories: Broad focus, many categories.

The top 5 countries for ecommerce

When targeting healthy margins, it’s worth looking a bit deeper at which specific countries have the strongest ecommerce markets and where the purchasing power is highest.

A mature ecommerce ecosystem can enable more rapid expansion and better customer experiences.

Ecommerce goes hand-in-hand with high levels of internet penetration, and this often coincides with relatively wealthy consumers with high purchasing-power parity. Combined, these paint an attractive landscape for healthy margins.

#1 China

Based on population alone, China is a massive market. It also has the largest ecommerce market in the world, attaining US$1.5 trillion in 2022. With a population of 1.4 billion and an internet penetration rate of 76.4%, this is one market worth trying to crack. Although China’s purchasing power parity per capita is relatively low ($ 17,600), this is likely to increase in coming years, as will internet penetration.

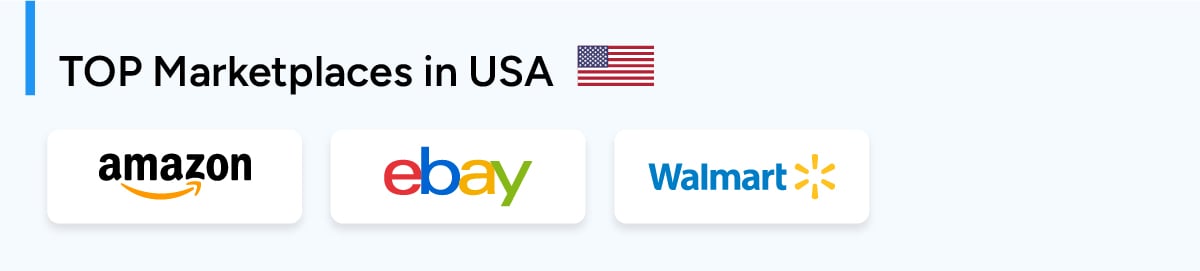

#2 USA

The United States has the second biggest ecommerce market in the world, with revenue of US$875 billion in 2022. The population of the USA is more than 340 million people, of which 91.8% are regular Internet users. The purchasing power parity per capita (PPP/capita) is also very healthy, at $63,700, making Americans the 8th most affluent consumers in the world.

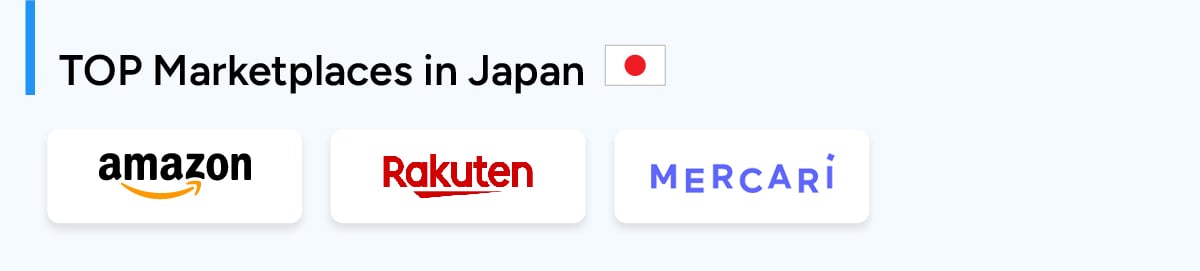

#3 Japan

This densely-populated nation has a thriving ecommerce market, with revenue of US$241 billion in 2022. Japan has a very high internet penetration rate, meaning 94% of Japan’s 123 million people are online. PPP/capita is also relatively high, making Japanese consumers the 34th most affluent in the world.

#4 Germany

Germany’s reputation as the economic powerhouse of Europe is well-founded, and it has the 4th largest ecommerce market in the world. In 2022, some US$148 billion worth of goods were bought online in Germany, making it 1/10th the size of the Chinese ecommerce market with just 0.0059% of the population. The population of Germany currently stands at 83 million people, of whom 93.1% are internet users. PPP/capita is also quite high, at $53,100 (ranked 26th).

#5 United Kingdom

With a population of 67 million people, the United Kingdom (UK) has one of the world’s strongest markets for online sales, and marketplaces have taken the prime position. An outstanding 98% of the UK’s population is online, making the UK one of the most internet-friendly countries in the world. The ecommerce market is valued at $143 billion, and the UK’s PPP/capita is $46,800 (ranked 35th).

How to start selling on the world’s online marketplaces

By selling to new customers around the world via online marketplaces, you can introduce your brand to new markets, grow sales revenues, and add resilience to your sales model. A multichannel approach is the most successful, although it involves some more work to get this set up. This way, you can target each specific market with the right combination of global marketplaces, local channels, and niche marketplaces that have less competition and better margins.

It can seem a bit daunting at the start, but this task is achievable when you have the right capabilities and advice on your side. This is the best way to start: fully prepared for the challenges ahead and with all obstacles moved from your path.

Making it easier to grow sales

We developed the ChannelEngine platform to make it easier to scale online sales and grasp the opportunities of multichannel marketplace selling. It gives ecommerce managers everything they need to manage sales across multiple sales channels, countries, and fulfillment locations/methods. ChannelEngine takes the headache out of global marketplace selling by streamlining, synchronizing, and automating every possible process with advanced tooling and AI-powered solutions.

To lower the threshold for new market access, we also have an extensive global network of strategic partners, who can offer advice, fulfillment, and logistics services, or any other capability needed to bridge the gap to your successful future.

Speak to a team of experts for a live demo!